- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Central Banks

- US dollar drops as the economy shrinks by 0.9% for the last quarter.

- Home

- News & Analysis

- Articles

- Central Banks

- US dollar drops as the economy shrinks by 0.9% for the last quarter.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS dollar drops as the economy shrinks by 0.9% for the last quarter.

29 July 2022 By Adam KahlbergUS economic data revealed last night shows that the country’s GDP has shrunk by 0.9%, although some are remaining positive that a recession may still be avoided. Despite the worrying figures, Federal Reserve Chair, Jerome Powell, outlined his belief that due to low unemployment figures of 3.6% and a strong market for jobs with 11 million job openings that there may be a ‘soft landing’. Joe Biden commented, “It’s no surprise that the economy is slowing down as the Federal Reserve acts to bring down inflation.” More US CPI data is expected to be announced tonight.

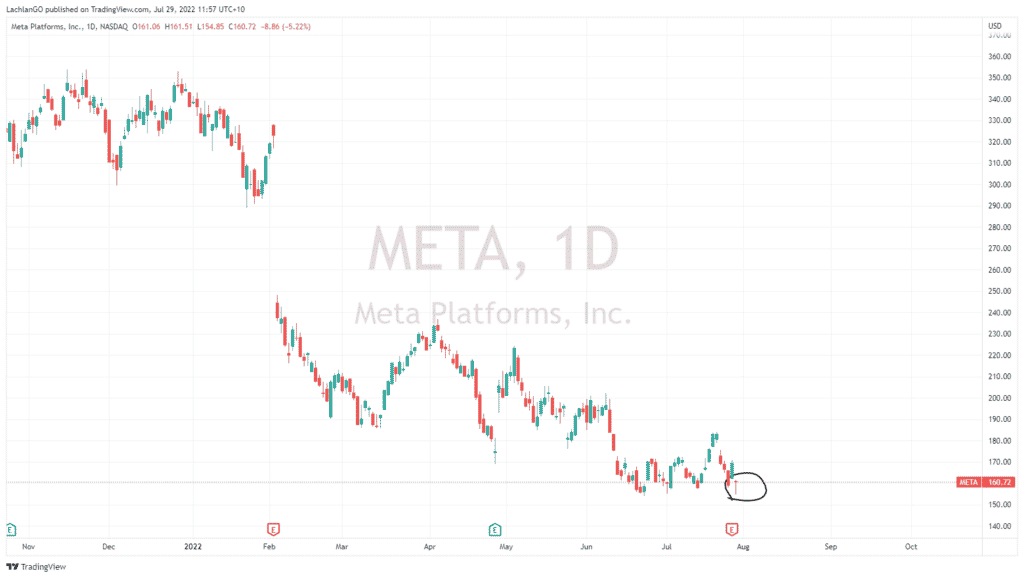

In response to the GDP figure, the US indices had another green day with the Dow Jones, the Nasdaq, and the S&P500 all rising 1.03%, 1.08%, and 1.21% respectively. In terms of share price movement, Meta’s stock price dipped 5.22% as it posted its first-ever quarterly drop in revenue, signaling how interest rate hikes have been impacting growth companies.

The data also followed through to the Australian market with the yield on 3-year government bonds falling to 3.1%. The ASX200 also continued its momentum for the week as it pushed higher again on Thursday.

Brent Crude Oil had a mixed day ending the day flat at $107.58. Gold continued to bounce off its support zone and climbed up 1.25% and Natural Gas fell 4.66% as it continues to pull back from its recent highs dropping 4.66%.

FOREX and Cryptocurrency

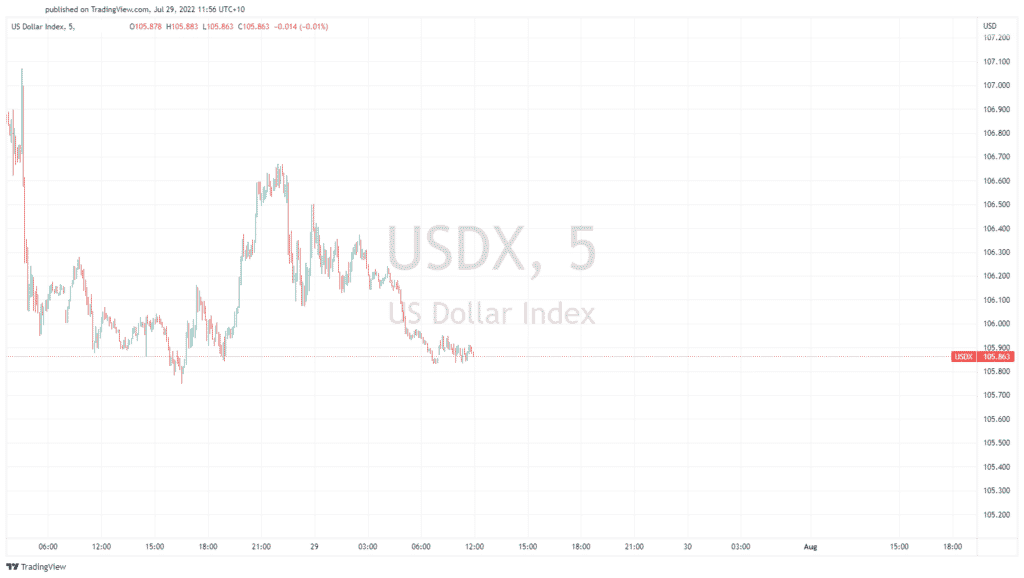

The USD dropped sharply as the GDP figures were announced. It recovered briefly, before selling back down, closing towards the lowest price of the day, a total drop of 0.28%. Bitcoin and Ethereum also gained momentum as money continued to flow back into risk assets, with the latter jumping to its highest level since the middle of July. ETHUSD closed at $1726 and Bitcoin at $23,860.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

RBA preview – likely 50bp hike incoming

Todays RBA policy meeting is expected by most analysts to result in a 50bp hike as the bank tries to play catch up and get on top of elevated inflation figures. The slightly lower Q2 CPI figures released last week has seen futures markets price out what was earlier feared could be a 75bp supersized move, a 50bp hike would see the ban...

August 2, 2022Read More >Previous Article

Is it time to Capitalise on Short Squeezes?

Is it time to Capitalise on Short Squeezes ? Short Squeezes are one of the interesting price action patterns that can occur in the market...

July 29, 2022Read More >