- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Record-Highs in the Stock Market

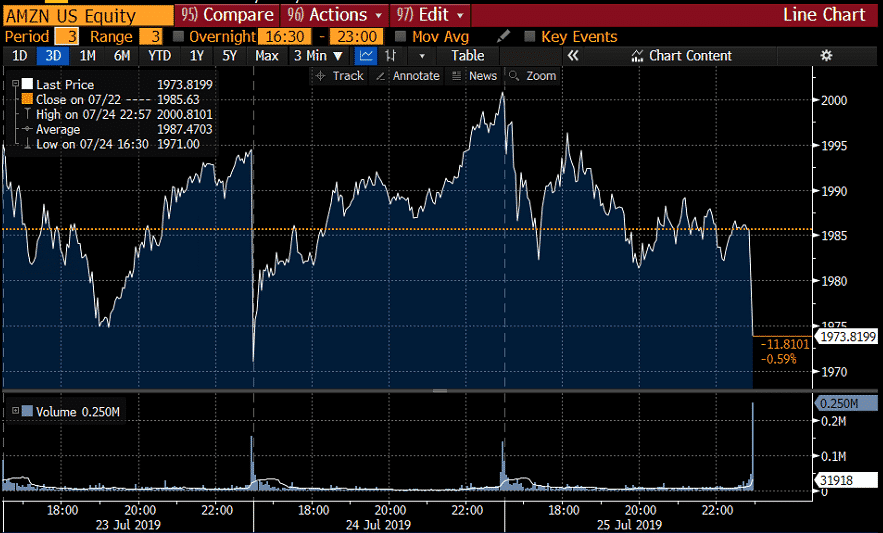

- Net sales are expected to be between $66.0 billion and $70.0 billion, or to grow between 17% and 24% compared with third-quarter 2018. This guidance anticipates an unfavourable impact of approximately 30 basis points from foreign exchange rates.

- Operating income is expected to be between $2.1 billion and $3.1 billion, compared with $3.7 billion in third quarter2018.

- This guidance assumes, among other things, that no additional business acquisitions, investments, restructurings, or legal settlements are concluded.

News & AnalysisRecord-Highs in the Stock Market

Global Stock Market

Record Highs

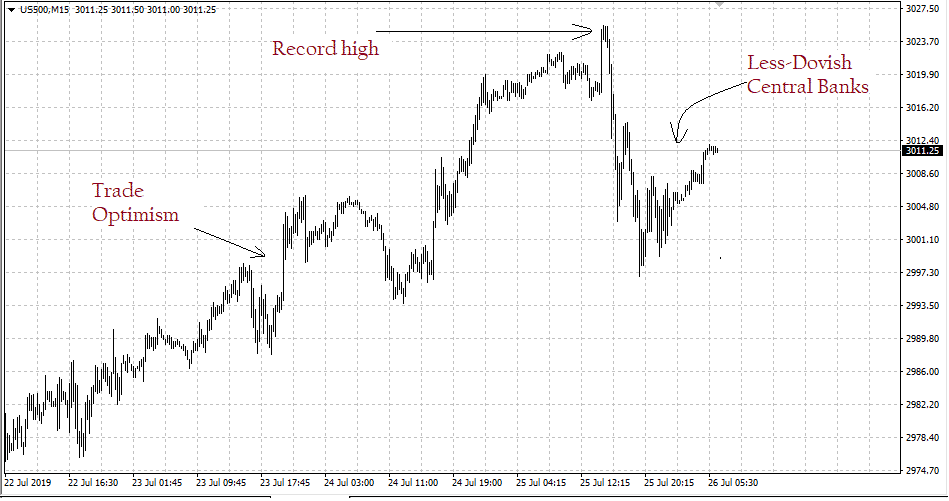

Amid geopolitical tensions, mixed earnings report and less-dovish central banks, this week, we still saw some more record highs in the stock market.

Nasdaq Composite closed at a record high at 8,321.50 on Wednesday as technology stocks rallied on strong earnings, trade optimism, and a US budget deal at the beginning of the week.

S&P 500 also traded at an all-time high at 3,019.56 on Wednesday, which brings its annual percentage change to 19.82%.

However, the momentum slowed down towards the end of the week with mixed earnings and less-dovish central banks. S&P500 widely regarded as the best single gauge of large-cap US stocks dropped by 0.50% while Nasdaq Composite finished 1% lower on Thursday.

US500 (S&P500) – 15 Mins Chart

Source: GO MT4

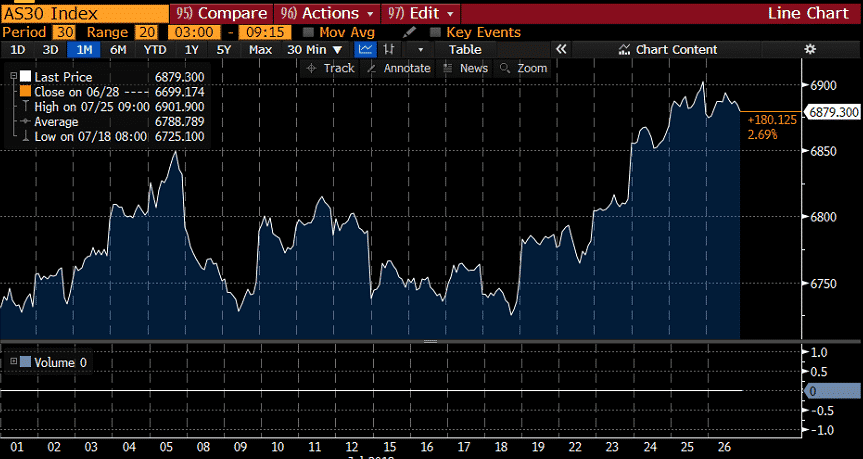

In the Australian share market, the All Ordinaries index, the oldest share index, which is made up of 500 largest companies listed on the ASX, reached an all-time at 6,901.90 on Thursday.

Source: Bloomberg TerminalThe S&P/ASX200 was just 10 points away from its best close ever. Unlike the ECB, the RBA Governor Lowe was more dovish during his speech stating that “if demand is not sufficient, the Board is prepared to provide additional support by easing monetary policy further.”

Major Earnings Reports

As the week progressed, earnings went from being strong to mixed. Attention was mostly on the major companies from the FAANG Group.

Amazon:

Amazon reported its quarterly updates after the closing bell, and shares of Amazon slipped by 2.5% in the after-hours trading. The company saw earnings of $2.6bn, and revenue was $63.4bn, which is up from the $52.9 billion a year ago. However, the figures came below estimates, and it is the first time Amazon reported income below analysts’ consensus.

The main highlight for Amazon was Prime Day, which was the largest shopping event in Amazon history. The weaker-than-expected profit is mostly due to the investment in expediting deliveries to Prime customers, which the company previously announced. The actual cost of speeding shipping was higher than anticipated, and it will be one of the key metrics investors will be monitoring for the next quarter.

Third Quarter 2019 Guidance

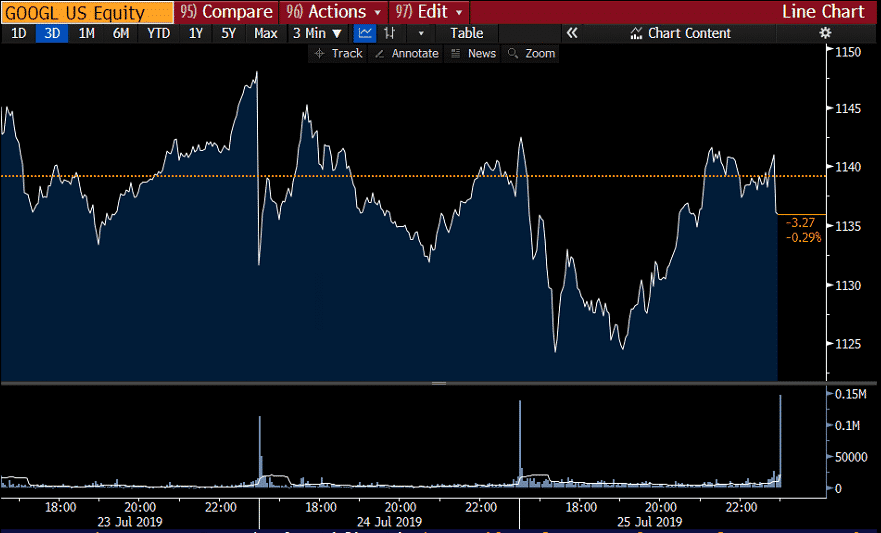

Source: Bloomberg TerminalGoogle:

Google’s parent company, Alphabet, reported higher than expected revenue at a time where the tech giant is facing increasing scrutiny from the US regulators. The second-quarter revenue is $38.9 bn, which is a rise of 19% compared to 2018 Q2. Its share price rose more than 7% in the after-hours trading.

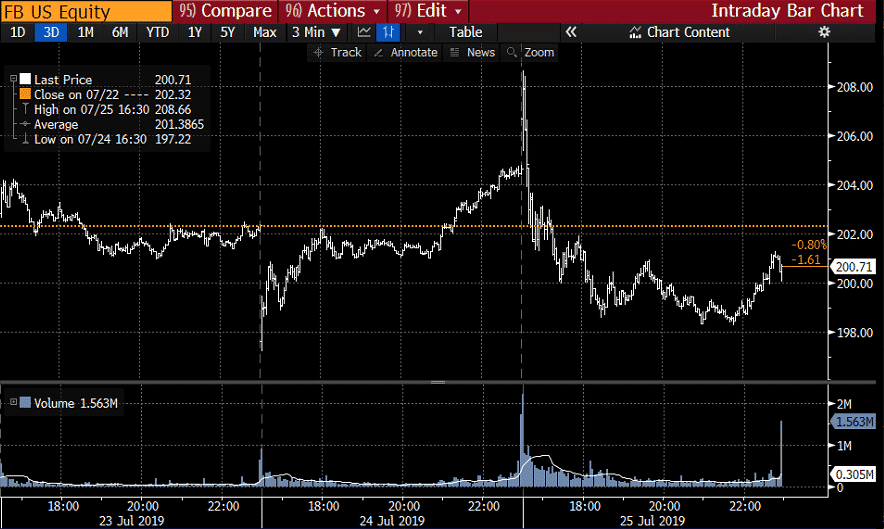

Source: Bloomberg TerminalFacebook:

Facebook’s earnings beat forecasts despite data scandal. The 2019 figures include an additional $2.0 billion legal expense related to the U.S Federal Trade Commission (FTC) settlement.

“We had a strong quarter and our business and community continue to grow,” said Mark Zuckerberg, Facebook founder and CEO. “We are investing in building stronger privacy protections for everyone and on delivering new experiences for the people who use our services.”

We also note that Facebook struck a $5 billion settlement with the FTC following the 2018 Cambridge Analytica scandal.

Shares were on the downside despite upbeat results as the CFO expects “more pronounced deceleration in the fourth quarter and into 2020, partially driven by ad-targeting related headwinds and uncertainties”.

Source: Bloomberg TerminalReady to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

3 significant benefits of having an FX trading buddy

By Mike Smith Let’s face it, trading can be a lonely occupation sometimes. Along with the hope of picking up a “hot tip”, this seems to be a key reason why trading forums are so popular. Unfortunately many people leave such forums almost as quick as they join them, simply because many users are not particularly supportive and often seem...

July 29, 2019Read More >Previous Article

Tesla Second Quarter 2019 Update

Tesla Second Quarter 2019 Update Tesla, the electric car maker, reported its second-quarter earnings on Wednesday in late US trading hours. Despite ...

July 25, 2019Read More >