- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- ASX200: the Top 5

- Market cap: A$125 billion

- Share price: $73.29 per share

- Founded: 22 December 1911 (as a government bank), 1991 (as a public company)

- Headquarters: Sydney Australia

- Market cap: A$113 billion

- Share price: A$38 per share

- Founded: Broken Hill Proprietary Company Limited (BHP) 1885; Billiton plc 1860; Merger of BHP & Billiton 2001

- Headquarters: Melbourne, Australia

- Market cap: A$89 billion

- Share price: A$26.81 per share

- Founded: 1982

- Headquarters: Sydney, Australia

- Market cap: A$88 billion

- Share price: A$193.03 per share

- Founded: 1916 (Federal government department), privatized in 1994

- Headquarters: Melbourne, Australia

- Market cap: A$73 billion

- Share price: A$26.72 per share

- Founded: 2 March 1835

- Headquarters: Melbourne, Australia

News & Analysis

GO Markets recently announced the addition of ASX (Australia Securities Exchange) Share CFDs to the product offering, increasing the number of instruments available to its clients to over 250, which also includes Forex, Commodities, Indices. The latest addition will enable clients to trade multiple assets from one single platform. In this article, we will take a look at the top 5 largest companies (by market cap) listed on the ASX200 index.

About ASX200

ASX200 is Australia’s leading share market index and includes the top 200 ASX listed companies by way of float-adjusted market capitalization. The total market cap of the index stands at A$1.8 trillion making it the 16th largest stock exchange in the world.

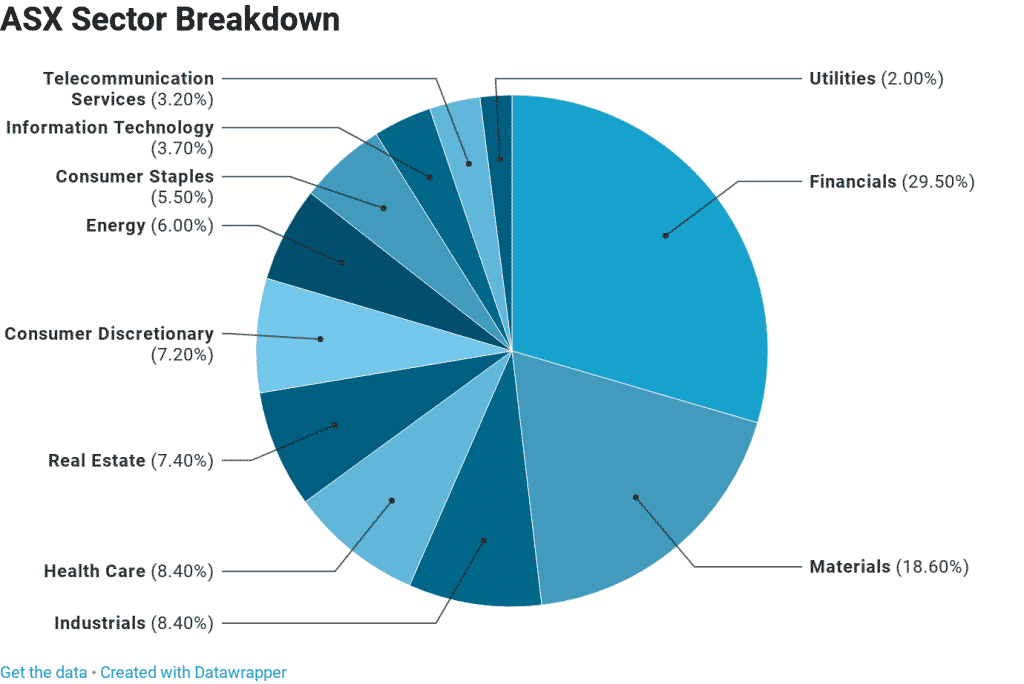

Financials make up the largest part of the total market cap at 29.5%, followed by materials and industrials at 18.6% and 8.4% respectively.

1. Commonwealth Bank of Australia

1. Commonwealth Bank of AustraliaCommonwealth Bank of Australia (CBA) is an Australian multinational bank with businesses across New Zealand, Asia, the United States, and the United Kingdom. It is the largest bank in Australia and the leading provider of financial services, including retail, banking and institutional banking, premium, funds management, insurance, superannuation, investment, and share-broking products. The bank has over 19.9 million customers worldwide and employs around 48,900 people.

2. BHP

BHP, formerly BHP Billiton, is a multinational mining, metals and petroleum company primarily in Australia and the Americas. BHP operates under a Dual Lister Company structure with two parent companies – BHP Group Limited and BHP Group Plc and they operate as a single entity, referred to as BHP. It is one of the top producers of iron ore, metallurgical coal and copper in the world with over 62,000 employees and contractors.

3. Westpac Banking Corporation

Westpac Bank Corporation (WBC) is Australia’s first and oldest bank. Some of the products Westpac offers include finance and insurance, consumer banking, corporate banking, investment banking, investment management, global wealth management, private equity, mortgages and credit cards. Westpac has over 35,000 employees worldwide.

4. CSL Limited

Commonwealth Serum Laboratories (CSL) is a global biotech company, which develops and manufactures pharmaceutical and diagnostic products. CSL is one of the largest and fastest-growing protein-based biotechnology businesses and a leading provider of in-licensed vaccines.

5. Australia and New Zealand Banking Group Limited

Australia and New Zealand Banking Group (ANZ) is the third largest bank in Australia and the largest in New Zealand. It also among the top 50 banks in the world. It operates in over 34 markets across Australia, New Zealand, Asia, Europe, America, and the Middle East. It has around 40,000 employees serving retail, commercial and institutional clients around the world.

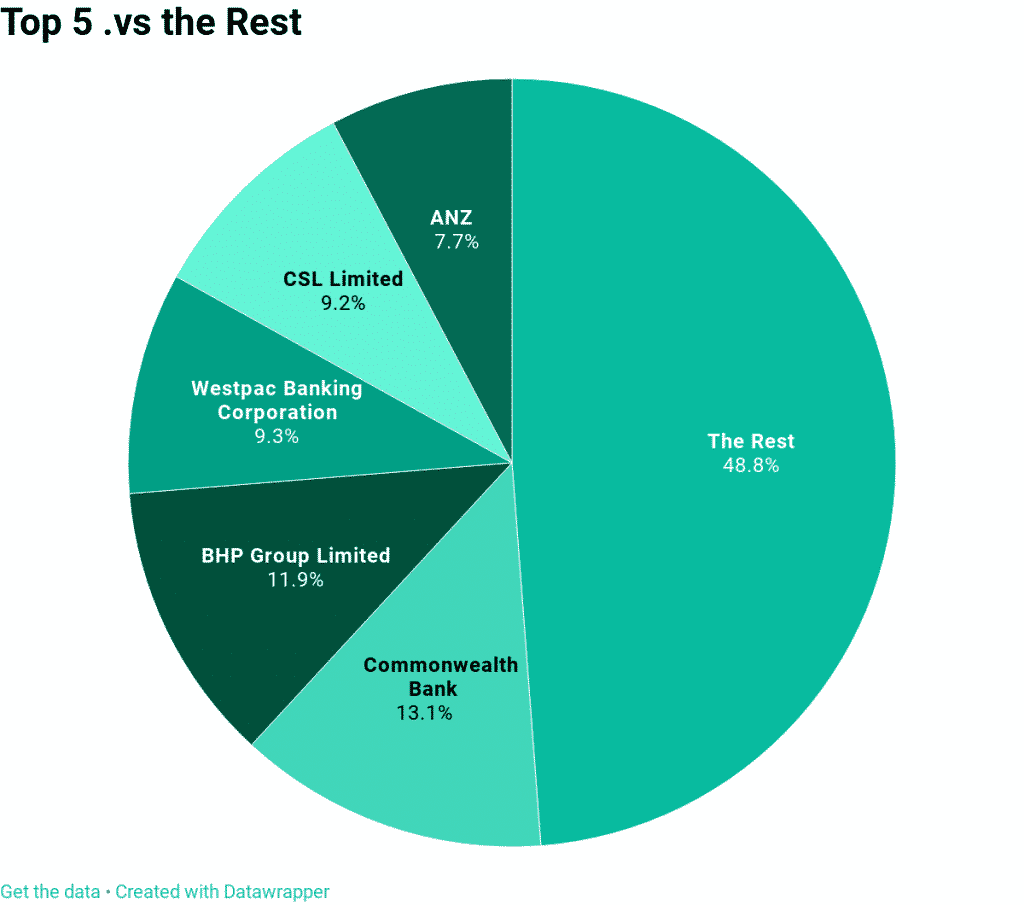

It is worth pointing out that the top 5 largest companies make up a whopping 51.2% of the total market cap of the whole index.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: ASX, Market Index, Datawrapper

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

GO Markets’ Giant Leap into MENA; Granted DMCC and DGCX Membership

MELBOURNE, AUSTRALIA – 18 April 2019. GO Markets is pleased to announce its expansion into the Middle East and Northern Africa (MENA) region, operating as GO Markets MENA DMCC in Dubai, UAE. Located within the economic ‘free zone’ of the Dubai Multi Commodities Centre (DMCC), GO Markets MENA DMCC has obtained its membership with the Dubai G...

April 17, 2019Read More >Previous Article

Largest Crude Oil Reserves in the World

We have seen the price of crude oil (USOUSD) rise by about 43% since the beginning of the year, from around $44 per barrel to $63 per barrel at the ...

April 16, 2019Read More >