- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Geopolitical Events

- International Monetary Fund (IMF): Growth Warnings

- Home

- News & Analysis

- Geopolitical Events

- International Monetary Fund (IMF): Growth Warnings

- Germany is experiencing weakness in the auto industry, following new fuel emissions standards and soft private investment.

- Italy is facing weak domestic demand and high borrowing costs.

- France is being dragged by yellow vest protests and weak industrial production.

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

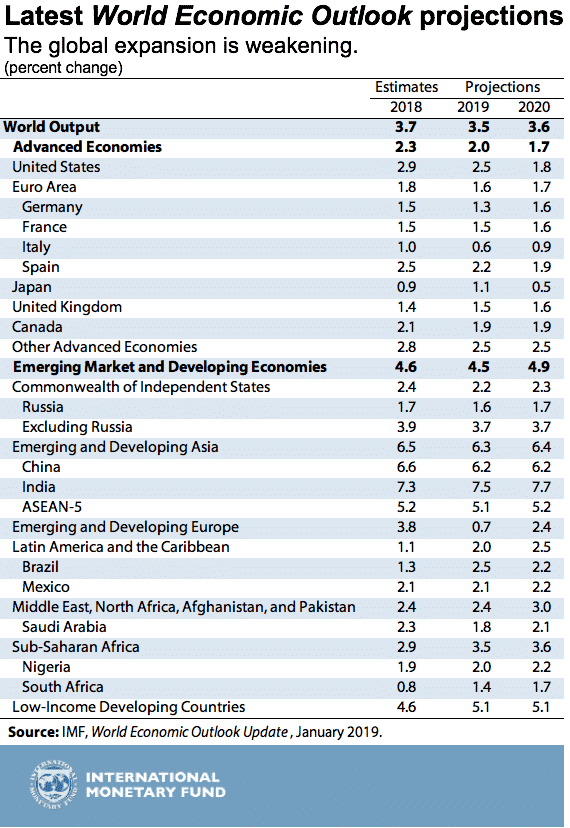

The World Economic Outlook has further shifted to the downside. The growth estimates for 2019 and 2020 were downgraded in October 2018 mainly due to trade tensions. The recent further downward revisions were the result of the weakening momentum in key industrialised economies.

The table below depicts the “Weakening Global Expansion”:

The outlook for Developed Economies

Eurozone Area: The most significant revisions came from Europe- mainly Germany and Italy.

In addition to the above, the rise in populism in the Eurozone area, Brexit and cross-border spillovers are some other Europe-specific factors that are weighing on economic activity.

United States: Washington is in gridlock, and the fiscal sugar rush died down. The US expansion continues, but growth momentum will soften. In comparison with the Eurozone area, the US’s growth will remain high. The prolonged US government shutdown is also posing risks to economic activity.

Japan and the United Kingdom: Despite natural disasters in Japan and Brexit in the UK, IMF has upgraded growth forecasts for these two economies. Japan’s fiscal support and mitigating measures to the tax hike enabled the IMF to revise the estimates to the upside. Given that the uncertainty around Brexit is eliminated and a deal has been reached, the UK economy is expected to move up because data has shown that it is not as sluggish as the Eurozone area.

The Outlook for Emerging & Developing Economies

China: Despite the recent stimulus program which will tackle some of the impacts of trade frictions, China’s economy is forecasted to slow towards the lower range of 6%. A combination of financial regulatory tightening, trade dispute and rout in commodity prices have caused a deeper slowdown than initially forecasted. The warnings from IMF is a reminder that China’s slowdown will have a global impact.

Saudi Arabia: Tumbling oil prices have forced IMF to also lower growth forecasts for Saudi Arabia.

India and Brazil: “India’s economy is poised to pick up in 2019, benefiting from lower oil prices and a slower pace of monetary tightening than previously expected, as inflation pressures ease.” The main factor behind the revisions is the declining commodity prices, which will eventually aid policy easing. Brazil’s recovery is expected to continue, which allowed IMF to upgrade its forecasts.

These moderate downward revisions to forecasts which were already revised down in October 2018 are warnings that investors will be keen to keep an eye on. IMF stretched the importance of recognising the growing risks, even though we are not anticipating a significant downturn at this stage.

This may be the reason why the World Economic Outlook is placing more emphasis on the Multilateral Cooperation, and call for policies as well to reverse the current headwinds and prepare for the forecasted downturn.

As of writing, the concerns about the global economic outlook have resurfaced with IMF warnings and its impact on risk sentiment can be seen in the Asian markets today.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Preview: The European Central Bank Rate Decision

On Thursday, the European Central Bank will announce its first policy decision of the year on whether to increase, decrease or maintain the interest rates. The decision is scheduled to be announced at 12:45 PM UK time. Why Is The Announcement Important? The European Central Bank is the central bank for the Eurozone, the countries which have adopt...

January 23, 2019Read More >Previous Article

Margin Call Podcast – S1 E1: Vee Leung Phan of Track Record Asia

Vee Leung Phan (@TrackRecordAsia) is the Founder of TrackRecord Asia and former Head of Trading across multiple divisions for Deutsche Bank and Mo...

January 20, 2019Read More >