- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Venezuela – The New Zimbabwe?

News & AnalysisVenezuela: A Latin American Crisis

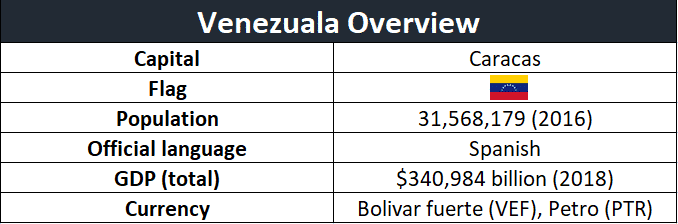

Venezuela’s economy has been in turmoil in recent times with its inflation skyrocketing and with no signs of slowing down, the situation may worsen. The political tensions have also been rising in one of the OPEC (Organization of the Petroleum Exporting Countries) member country whose economy has been slowly declining since the crash of oil prices in 2014. We have seen large protests against the highly unpopular president Nicolas Maduro, who won the most recent in May this year. However, most people called it a “show election” as it had the lowest voter turnout in Venezuela’s democratic history at 46%.

The Economy

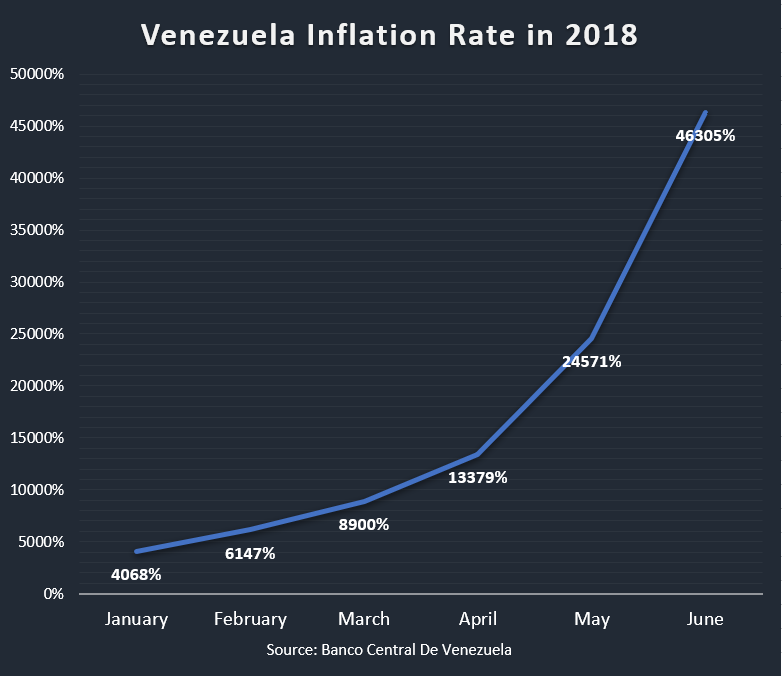

With the economic and social crisis rising in Venezuela, we have seen the countries inflation rise to new record highs. From reaching 4068% in January, we have seen the inflation reach 46305% last month. Experts are predicting the number could reach 1,000,000% by the end of 2018, according to the IMF (International Monetary Fund) economist Alejandro Werner and has compared it to Zimbabwe’s hyperinflation in late 2000’s.

It is worth pointing out that the second highest inflation in the world is in Sudan at 122%.

Shortages in electricity, water, and public transport affect millions of people of Venezuela. President Maduro blames countries poor economy on an economic war that he says is being led by the United States and Europe. IMF’s Alejandro Werner says that if the country’s economic and social crisis deepens, Venezuela’s economy could decrease by around 50% over the next 5 years which be one of the worst economic falls in over 60 years.

“The collapse in economic activity, hyperinflation, and increasing deterioration … will lead to intensifying spillover effects on neighbouring countries,” Werner wrote in a blog post.

IMF is estimating an 18% decrease in Venezuela’s economy in 2018, up from 15% drop it predicted back in April. That would be the third double-digit annual decline in a row.

Werner said the projections are based on calculations prepared by IMF staff, but he warned that they have a degree of uncertainty greater than in other countries.

“An economy throwing you these numbers is very difficult to project,” Werner said at a news conference. “Any changes between now and December may include significant changes.”

The Venezuelan Currency

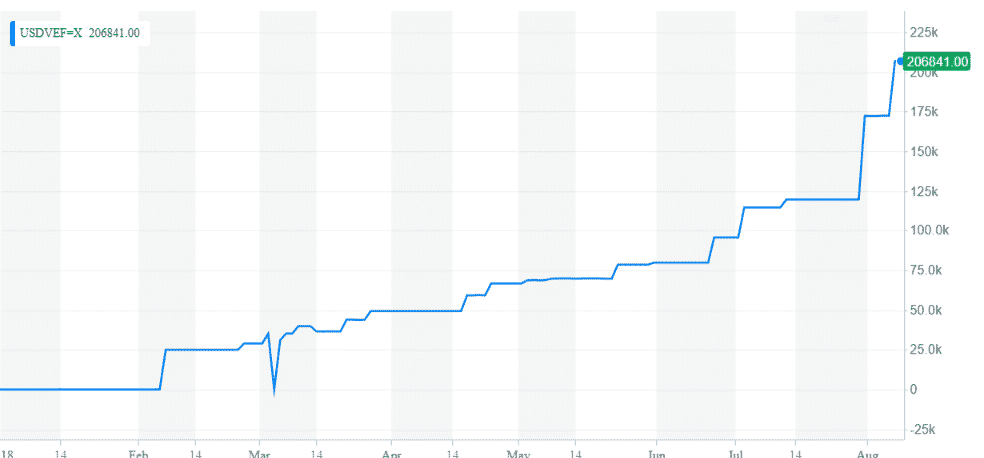

Countries official currency – Bolivar Fuerte (VEF) has weakened dramatically in recent times. 1 US Dollar is currently worth around 206841 bolivars.

The Venezuelan government has recently announced it will slash five zeros from its currency. The announcement was made on 25th July by President Maduro and it is part of a currency reform that was already scheduled for June and was a postponed on two occasions before. The existing Bolivar Fuerte banknotes, which range from 1,000 to 100,000 will stop circulating and will be replaced by the new “bolivar Soberano”, which will range from 2 to 500. The new currency is set to start circulating this month.

By Klāvs Valters

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: Yahoo Finance, Google Maps, Banco Central De Venezuela

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

China Taking Stock Of US Trade Deficit Figures

The US official trade deficit number with China is $375.2bn in 2017. But According to China Customs General Administration, this number should be $275.8bn. Notice there is a vast gap between the versions from two sides. So, which version is closer to the facts? Firstly, let’s start this debate by looking at the US perspective. Previously in the...

August 9, 2018Read More >Previous Article

Emerging Markets and a Hawkish Fed

In 2018, we have seen a growing interest in the Emerging Markets (EM) as a lot of advisers or asset allocators have been upbeat about these markets....

August 8, 2018Read More >