- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & Analysis

- Forex

- NAB tips two more RBA rate cuts

News & AnalysisUpcoming News

» 6:30pm Manufacturing Production – GBP

Overnight we saw small drops on the DOW and S&P500, Gold settled around its lows still finding support around 1333.50. Oil rallied higher with hopes OPEC will stabilize supply. The USD was mixed as the AUDUSD tested highs. The USDJPY rallied by 37 pips to test short a term high of 102.55.

NAB Australia tips two more RBA rate cuts, despite solid business. Chinese inflation see’s new lows as PBOC signals need for “Innovative” monetary policy. Asian and local equity markets have been a little stronger than I expected this morning with the Nikki increasing by 86.76 points. ASX200 up by 8.16 points at this point in the session. I expected flatter to slightly weaker sessions today. The HSI has followed my original thoughts currently lower by 0.19%. The EUR/USD is putting in a stronger Asian session off its lows and holding firm above 1.1070 support. The CAD continues to see sellers as the USDCAD is currently testing its weekly high at 1.3180. Gold has started to edge lower, I want to see 1333.50 holds on the short term to keep a trend continuation idea in play.

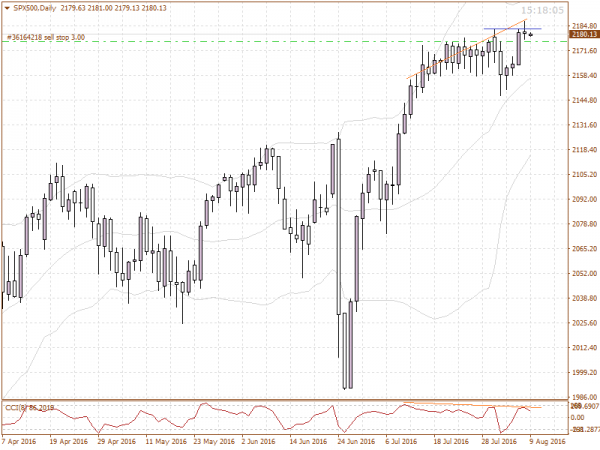

I’m seeing some signs we could see some weakness creep into stock indices tonight. A few are sitting and struggling at highs, more on this below.

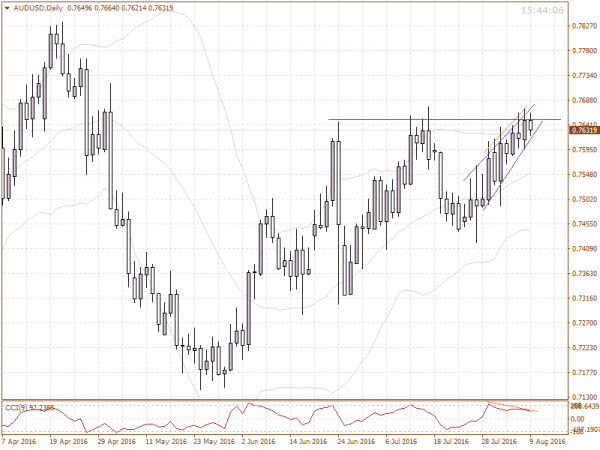

AUDUSD – Sell idea still forming for me at this point, I’m still looking for it to confirm. Divergence is still present. Buyers are still struggling to break through the upper resistance. The current move up is in more of an ending diagonal now than a clean cut trend channel. A break out tonight to the upside changes the picture entirely. Until this happens I’m continuing my wait.

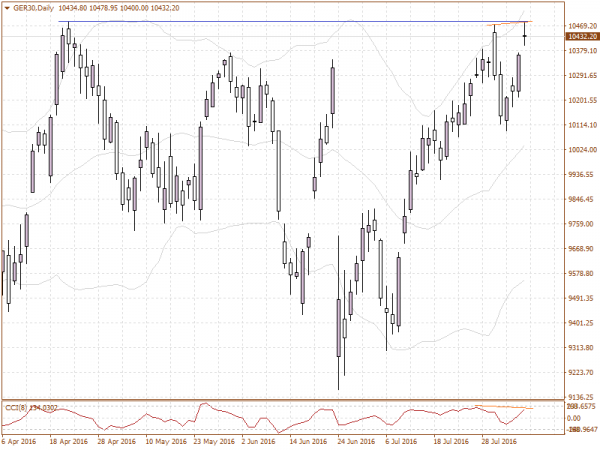

GER30 – Seeing a possible sell idea forming. We have seen price hit a previous high and find some selling pressure. The current candle can be seen as an evening star due to its gap. Divergence is starting to form. A rally tonight through the yesterday’s high cancels this idea out.

SPX500 – As with the above, price stalling at highs. Divergence has formed. I looking for price to close lower tonight to confirm a sell idea. If we have a stronger session tonight and break above 2188 my sell idea will be canceled.

Good Trading.

Please note that trading Forex and Derivatives carries a high level of risk, including the risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets. You should only trade if you can afford to carry these risks. Our offer is not designed to alter or modify any individual’s risk preference or encourage individuals to trade in a manner inconsistent with their own trading strategies.

All times are in AEST.

Written by Joseph Jeffriess, GO Markets Market StrategistReady to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The 200-Day Moving Average

One of the worlds most profitable Hedge Fund Managers Paul Tudor Jones called it in Tony Robbins Money Master Book "my #1 Trading indicator " and some of my colleagues in institutions and banks have referred to it as a key barometer for where substantial money flow often occurs. I am referring to the 200-Day Moving Average on a Daily chart and as...

August 17, 2016Read More >Previous Article

Oil continued its rise

Upcoming News » 10:30pm Employment Change - CAD » 10:30pm Trade Balance - CAD » 10:30pm Unemployment Rate - CAD » 10:30pm Average Hourly Earnin...

August 5, 2016Read More >

- Trading