- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Is the AUDUSD ready to reverse?

News & AnalysisRecent History

The USD has been on a tear in recent months as volatile market conditions have sent the currency rocketing. Inflationary pressures and recession fears have seen investors turn to the USD whilst at the same time taking off risk from the AUD. The AUD’s drop has also been further is largely due to a decrease in the price of commodities such as Iron Ore, Brent Crude, Wheat, and other key resources that rive much of the Australian economy. In addition, the AUD is seen as a risk currency. This means that the currency performs well when the economy is growing and the market is bullish and conversely suffers during times of volatility and slowed growth. There has been some positive price action to indicate that a reversal in the AUDUSD may be imminent.

Technical Analysis

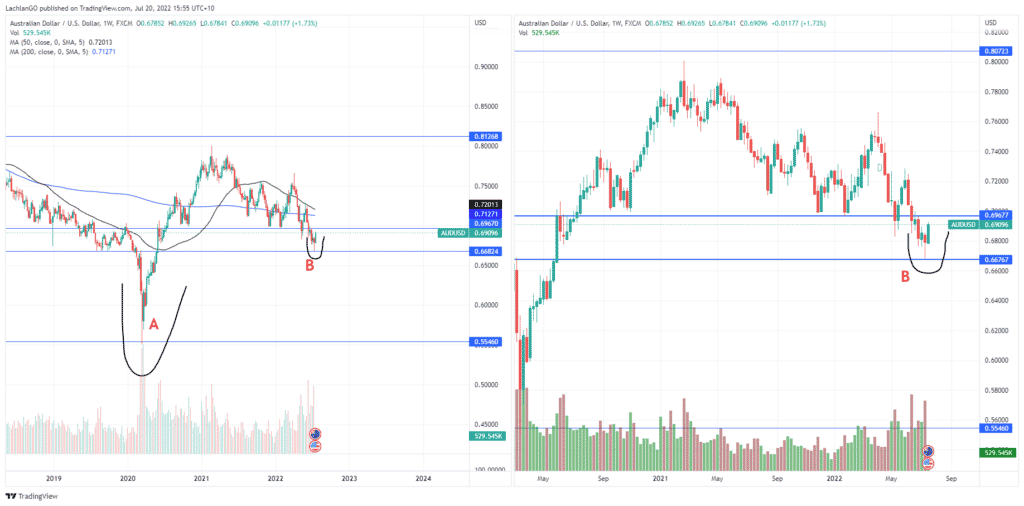

From a long-term perspective, the weekly chart shows that going back since 2015 the AUDUSD has been trading in a relatively stable range between approximately $0.6680 and $0.8126. The one exception to this was the onset of the Covid-19 pandemic which acted as a ‘Black Swan’ type of event towards the pair and the wider market, (A). This caused a mass panic and a subsequent sell off the AUDUSD. Once the initial panic began to subside the pair recovered and was able to recover back into the range. It is interesting to note that over the last few years the pair has reverted to its 50-week moving average, after aggressive moves in either direction. In recent weeks, a reversal does appear to be emerging. The candlesticks also support this by showing a red hammer candle followed by a relatively strong green candle indicating potential exhaustion, (B).

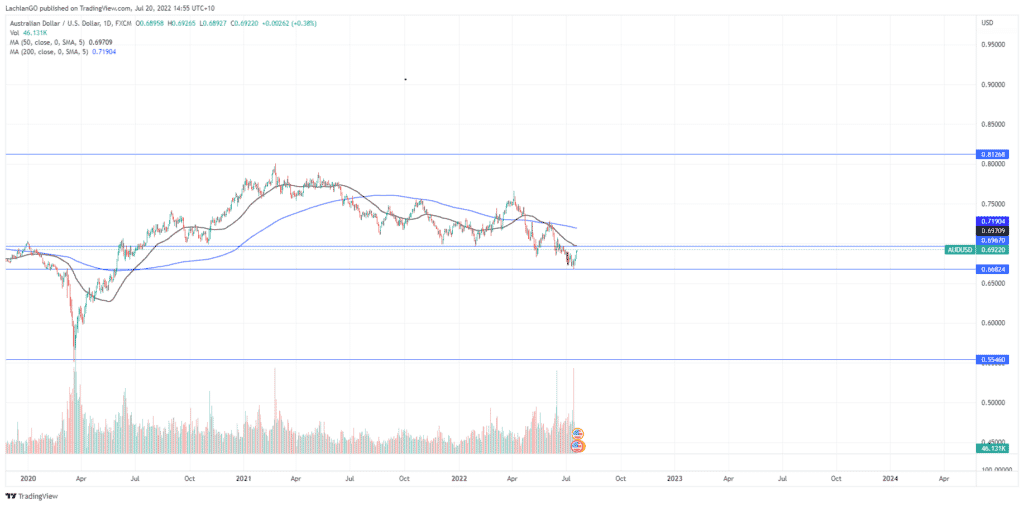

Looking closely at the daily chart can provide a few more targets in terms of potential price targets. The next most reasonable price target could be the 50-day moving average which is also doubles as the next level of resistance at $0.6970. If the price is able to break through this point, then it may go further target the 200 Day average of $0.7190. However, it will likely have to soak up a fair amount of selling pressure.

Ultimately the strength of this pair will largely depend on how accurately the market is pricing in inflation and a recession. If the selloff in equities has maxed out then it may positively effect the direction of the AUDUSD. However, if there is more pain to come then the pair may sell further down.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Short Term Break Out on the S&P500

The S&P 500 has been battered and bruised in one of the worst first half of the years in history. However, there are some signs that it may be turning. A short term long buying opportunity on the SPY looks to be apparent. With the recent bullish sentiment due to the market believing that much of the forecast slowing growth and interest rate ...

July 21, 2022Read More >Previous Article

Market jumps on the back of weak USD and better then expected earnings

The US stock market saw one of its best days in months, as speculation swirled that the 'bottom' may be in. The indices gained their momentum from bet...

July 20, 2022Read More >