- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Cryptocurrency

- Bitcoin to reach $45,000? Bitcoin ETF anticipation growing

- Home

- News & Analysis

- Cryptocurrency

- Bitcoin to reach $45,000? Bitcoin ETF anticipation growing

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisBitcoin displayed strong momentum yesterday, with a notable increase of over 10% and approaching a 15% gain within the day. Price surged and has breached the previous resistance level at 31,000. This level has historically acted as a significant barrier, causing the price to retreat to around 25,000 after multiple attempts to surpass it.

However, the market’s future movements are uncertain due to upcoming events such as the release of unemployment claims reports and a scheduled speech by Federal Reserve Chair Jerome Powell later this week. These events are expected to introduce volatility, potentially leading to significant market fluctuations.

Since price has surpassed the 31,000 range we will wait and see if it does undergo a support test, the next significant resistance level to watch out for is at 40,000. Conversely, there is a possibility that the price could face rejection at 31,000, leading to a decline back to the 25,000 support. It’s crucial to acknowledge that in the unpredictable realm of financial markets, no movement is guaranteed. This unpredictability underscores the importance of effective risk management strategies.

You may be asking but what’s the sudden surge?

What’s driving the sudden surge in BTC’s value, breaking the market’s prolonged stagnation since the collapse of Terra in May and the subsequent crash of the crypto empire FTX? One potential catalyst for this uptrend could be the optimistic market sentiment revolving around the possible approval of spot Bitcoin ETF applications by the U.S. Securities and Exchange Commission (SEC).

The promoters of Spot Bitcoin ETF tout it as a game-changer, poised to inject a significant influx of funds into the crypto market. Additionally, it aims to facilitate mainstream adoption and provide easier access for purchasing BTC, thereby broadening the pool of crypto investors.

BlackRock’s Spot Bitcoin ETF, known as the iShares Bitcoin Trust, recently made an appearance on a list maintained by the Depository Trust and Clearing Corporation (DTCC). According to Nasdaq, DTCC offers post-trade clearance, settlement, information services, and custody. Despite awaiting approval from the U.S. financial regulator, the DTCC has already listed the BlackRock fund under the ticker IBTC.

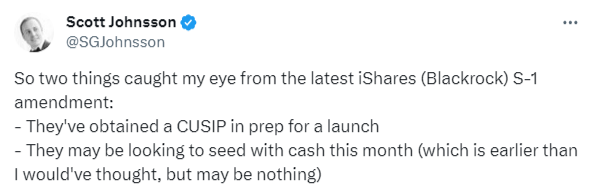

Finance lawyer Scott Johnsson shared these developments, highlighting that BlackRock has “secured a CUSIP in preparation for a launch” and suggesting that they might be considering seeding it with cash this month, an earlier timeline than anticipated.

What is seeding you may ask?

Before the launch of an ETF, an initial investment, commonly referred to as “seed capital,” is essential. This pioneering investor typically contributes around $2.5 million, giving this capital to the ETF issuer in exchange for an equivalent value in ETF shares. This process, known as “seeding the ETF,” is fundamental for the ETF’s inception.

Market makers play a crucial role in providing this seed capital to ETF issuers. By participating in this initial investment, market makers are accorded special privileges. They earn the title of “lead market maker” for that specific security, entitling them to specific benefits such as cash rebates and payments. These privileges are granted in return for the market maker’s commitment to maintaining a tightly regulated quoting level for the security in question.

Managing risk is paramount, especially during periods of high market volatility driven by news and reports. Traders should implement a robust risk management plan to safeguard their investments and navigate the market uncertainties successfully. Staying vigilant, being informed about market news, and having a well-thought-out risk management strategy are essential elements for traders aiming to thrive in such dynamic market conditions.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

US Markets take a hit and Aussie gives back CPI gains.

US markets took a big hit overnight after a mixed bag of earnings were released from the tech sector. Google’s parent company, Alphabet, took a 9.5 percent hit in yesterday’s session after releasing some disappointing earnings numbers on their cloud computing business. The $1.5+ trillion company has enough weight to pull down the indices wit...

October 26, 2023Read More >Previous Article

Is the Gold Run Over?

The recent surge in gold prices, following recent events in the Middle East and the declining US Dollar (DXY), raises the question: Is this the end of...

October 24, 2023Read More >