- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices Trading

- Share CFDs Trading

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs Trading

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile Trading Platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & Analysis

- Education Hub

- Economic Calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Plateauing is just another way of saying ‘stuck’

- Fruit and vegetables: from -1.2% YoY to 3.5% YoY

- Apparel: from 0.3% YoY to 2.4% YoY, with a 4% MoM increase

- Healthcare: from 4.1% YoY to 6.1% YoY

- Fruit: +7.3% MoM

- Oils and fats: +4.6%

- Women’s garments: +4.5%

- Children’s garments: +6.8%

- Accessories: +3.6%

- Furniture: +3.3%

- International holiday travel and accommodation: +11%

News & AnalysisLet’s make things very clear – Australia’s inflation rate is plateauing in fact I would argue it’s starting to reaccelerate in areas Australia can least afford. From a trading and momentum perspective this needs explaining.

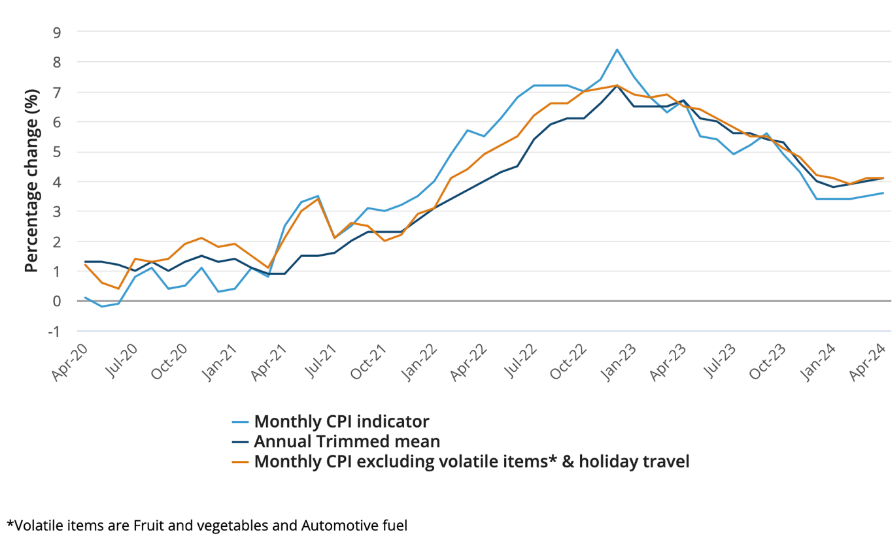

Stronger Than Expected Print

April’s CPI data exceeded expectations and was at the very top of the surveyed range. Headline CPI increased by 3.6% YoY, well ahead of the consensus of 3.3% YoY. Seasonally adjusted, the increase was even higher at 3.8% YoY. Both the headline and core CPI rose for the third consecutive month. This is a major concern.

Now, the monthly increase slowed sequentially to 0.2% MoM, annual headline inflation has risen every month in 2024. Then the RBA’s core: trimmed mean inflation rose from 4.0% to 4.1%, and the ex-volatiles measure increased from 4.1% to 4.2%, with a three-month annualized rate of 5%, there is clear daylight between the RBA’s target band of 2%-3% and the core measure of inflation

Here is the chart of the three main figures.

Monthly CPI Indicator annual moment (%)

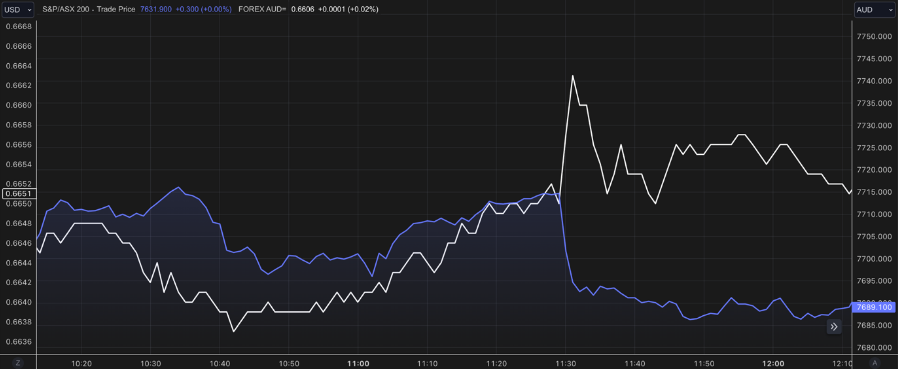

All this makes the RBA’s ‘narrow path’ almost unattainable. A point not lost on the AUD and the ASX as seen by each one’s initial reactions.

ASX 200 v AUD/USD

Source: Refinitiv

Broadening Persistence

However, with the passage of time the data is throwing up bigger concerns – and that is the persistence of price pressures in areas that make up large parts of the CPI basket.

The expectation for a weaker April CPI print was based partly on the skew towards goods in the sampling for the first month of the quarter which have been in structural decline.

However, both goods and services contributed to the rise. Notable increases were seen in categories such as:

The upside surprise was mainly due to significant increases in volatile expenditure items, including:

These items constitute 7.5% of the CPI basket and largely explain the forecast miss.

Then you have clothing, which was expected to fall by 0.4%, rose by 4.1%. Furnishings, household equipment, and services, expected to be flat, all increased by around 0.6%. Recreation and culture, predicted to rise by 0.8%, actually went up by 2.3% in April.

This point was not lost on the Bond market with both the 3-year and 10-year Australian bonds surge on the data seen here:

Australian 3-yr and 10yr Bond reactions

Source: Refinitiv

(Blue 3-year, White 10-year)

Goods Prices Acceleration

You can certainly explain away the volatile items as being affected by the early Easter period and a correction in the March data that had these items under pressure. But that ignores the seasonal and 3- and 6-month averages which are still high.

You can also ignore the volatile international travel and accommodation sector, which accounted for much of the forecast miss, but again you can’t ignore the acceleration in goods prices where deflation was expected.

Categories such as clothing & footwear, furniture, and other major household and electronic appliances, typically measured once per quarter, suggest that goods inflation will likely remain strong. The monthly measurement of goods inflation rose by 0.9% in April, adding 0.2 percentage points to the headline monthly CPI, marking the largest increase since April last year.

Services Inflation – the ‘sticking’ point

One of the floors with the April CPI print is that is was heavy on goods prices but light on services. This will be reversed in May – services prices are expected to remain fairly sticky. These are the areas the media like to quote like dentists and hairdressers. But somewhat cheapens the services that do move the dial, rents, telecommunications, financial service and insurances etc. these are big components of the CPI basket.

Considering the upside miss in April and the anticipated persistence of services inflation in May and June, the consensus now for Q2 headline CPI has been upwardly revised to 0.9% QoQ (range of 0.6% to 1.2%), that implys an annual reading of 3.7%. For core inflation (trimmed-mean), it has been adjusted to 0.8% QoQ, implying an annual reading of 3.8% – which is in line with the RBA’s new forecast.

Implications for the RBA

The implications from this CPI print will challenge the Reserve Bank of Australia (RBA). It does pressure its assumption that the re-acceleration in inflation in Q1 would quickly revert. The unexpected strength in goods in particular coupled with sticky services suggests more persistent inflationary pressure than initially anticipated. It also shows that ‘inflation psychology’ is real – there is an argument to be made that spending has maintained on the ‘idea’ cuts would come because inflation is falling. Which has left enough demand in the economy to hold inflation up.

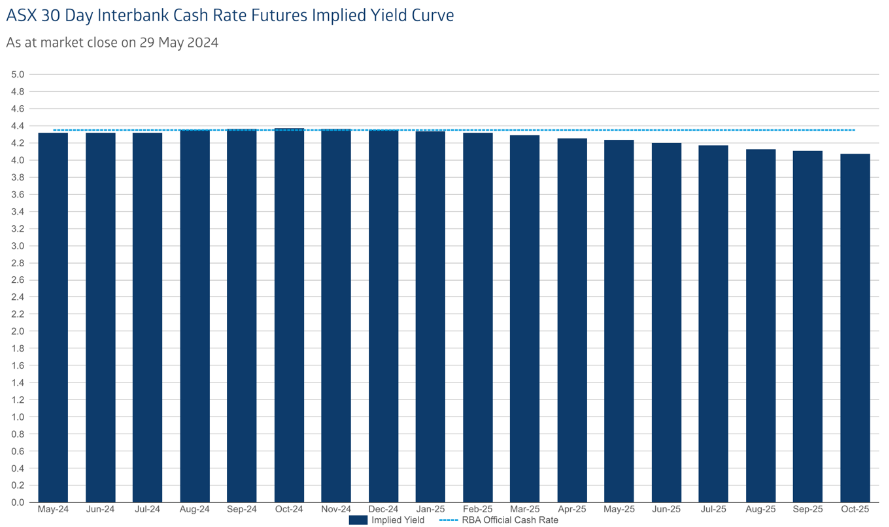

So, does this imply the RBA is about to raise rates?

Here is the market’s pricing on that idea.

Interestingly enough despite the hawkish risks, the likelihood of the RBA hiking rates is still tempered in the market and explains why the AUD in the hours since the CPI has moderated.

Why? Emerging signs of activity weakness.

Retail sales have been weak, corroborated by several companies reporting soft trading updates. Then there was Q1 construction work done which was released at the same time as the CPI data – significantly missed expectations (-2.9% QoQ versus the expected 0.5%) that is a huge miss.

Things the RBA will be watching over the coming week is the Fair Work Commission’s Minimum Wage decision on Monday and the Q1 GDP release next Wednesday. These events will be crucial in assessing the broader economic outlook and potential RBA policy responses. Anything that has an upside surprise should be seen as a AUD positive and an index negative.

The RBA will likely need to jawbone this result to further slow household demand for non-essential items, which is way we highlight the ‘inflation psychology’ term and the effect ‘anticipation’ is having. However, as the market and economist point out it is unlikely that the RBA will increase interest rates again, as this would disproportionately impact households already struggling under tight financial conditions.

Thus – we are stuck in this weird holding pattern and as other central banks around the world begin to cut rates it will attract flows to the AUD and its higher yields. There is a silver lining here too – as countries cut due to their respective disinflation moves and thus cheaper imports, this will benefit Australia’s inflation problem but that is a way off and the AUD will remain attractive for a while to come.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The race has begun – who is left holding the rates bag

FX and indices traders are now on notice – the race to restart economies is upon us. We have to-date seen Riksbank and SNB move policy but with the Bank of Canada (BoC) now entering the rate cut movement – the race is now well and truly on and the interest rate differentials that come into play with currencies will ramp up. Potential for Fur...

November 1, 2024Read More >Previous Article

Moving forward – the volt revolution of transport

The transportation of the world is becoming one of the most interesting trading places in markets as we clearly have a structural long-term change com...

November 1, 2024Read More >